Building an MCP Agentic Stock Trading System - Part 7: MCP Experimentation Lessons

After building three AI trading agents with MCP, here's what I'd do differently.

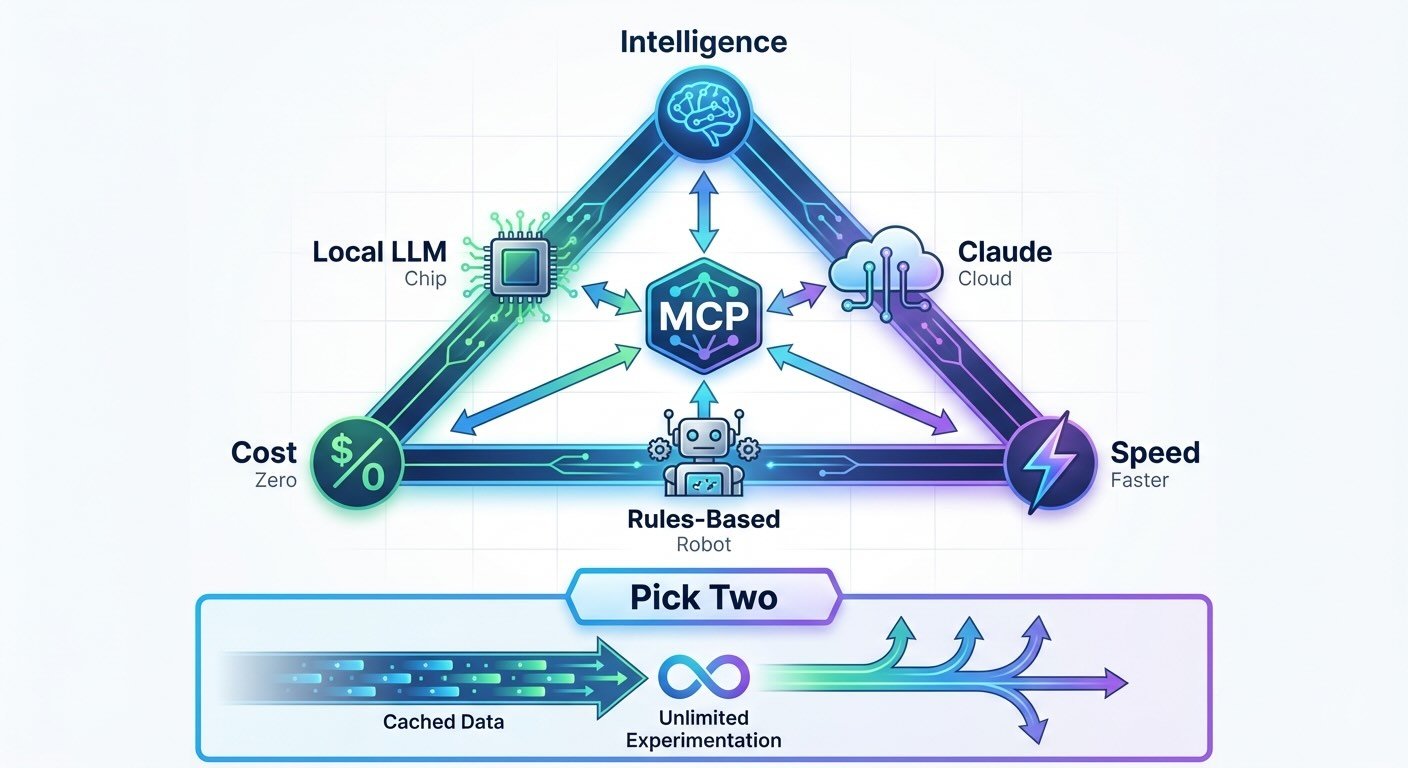

Building an MCP Agentic Stock Trading System - Part 6: Cloud vs Local vs Rules

Building with three agent types taught me: you can optimize for speed, cost, or intelligence—pick two.

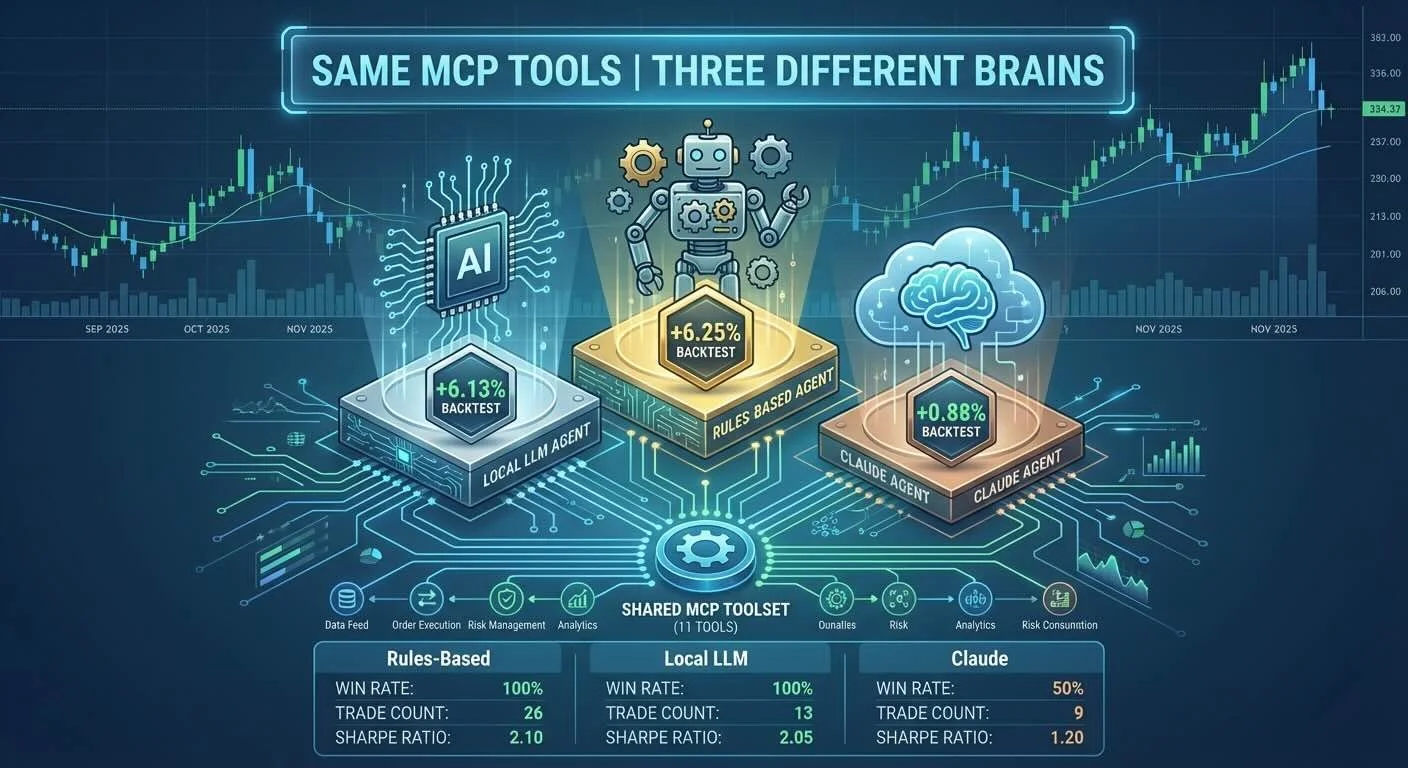

Building an MCP Agentic Stock Trading System - Part 5: Backtesting All Three Agents

I ran all three agents over 2 months of real market data to see how MCP handles different "brains" with the same tools. The results surprised me—but not in the way I expected.

Building an MCP Agentic Stock Trading System - Part 4: When Agents Disagree

Three AI agents analyze Apple stock on the same day. Two reach the same conclusion through reasoning, one through arithmetic. What does this reveal about AI decision-making?

Building an MCP Agentic Stock Trading System - Part 3: The Agentic Loop

The agentic loop is where LLMs become active problem-solvers instead of passive responders. The LLM doesn't just answer once—it iteratively calls tools, analyzes results, and decides what to check next. My trading agent uses this to analyze stocks: fetch data, calculate indicators, check trends, then make a decision.

Building an MCP Agentic Stock Trading System - Part 2: The MCP Servers and Tools

MCP servers are like USB hubs for AI—they provide standardized tools that any agent can plug into. My trading system has two: one fetches market data, the other calculates technical indicators. Write them once, use them with Claude, local LLMs, or even traditional code.